EQT Private Equity, part of a publicly listed investment firm (EQT AB Group) is taking Billtrust (BTRS) private. Billtrust went public (via SPAC) in early 2021. Wrap your head around those two sentences for a minute and marvel at modern capitalism.

Billtrust

I’m not going to write a lot about Billtrust because they have an excellent investor presentation available here. (I’d suggest downloading it before it disappears!)

Billtrust is a leader in the accounts receivable space, with a burgeoning payments acceptance and payments network business. The company began in e-billing, expanded into broader AR functions, became a payment facilitator, and eventually built a payments network by connecting to AP providers. It really is a pioneer.

The EQT/Billtrust Deal

I don’t normally opine on valuations, but in this case, I’ll make an exception for two reasons:

- valuations have been so volatile lately and

- as you will see below, this deal may have implications for a bunch of other public companies.

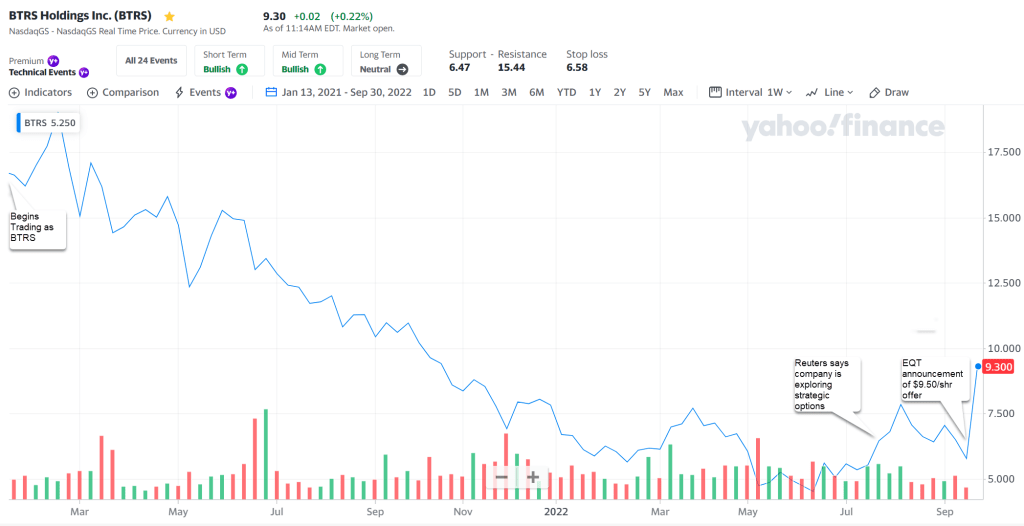

The chart above shows Billtrust’s stock price from the time of the de-spac when it began trading as BTRS to today. EQT offered $9.50/share, or a total value of $1.7 billion for the company.

As EQT points out in its press release

The price per share represents more than a 64 percent premium above the closing share price of $5.77 on September 27, 2022, and more than a 76 percent premium above the trailing 90-day volume weighted average stock price for the period ended September 27, 2022.

(I’d also note that the premium was really a bit higher in that Reuters wrote that the company was considering strategic options in late July which moved the price up a bit.)

This price for Billtrust represents:

- a 10x multiple of FY2022 guided net revenue (net revenue excludes reimbursable costs, much of which is postage!)

- an 8x multiple of expected FY2023 net revenue (according to BAML’s analyst)

- a 12.5x multiple of FY2022 guided software and payments revenue (this excludes about 15% of BTRS revenue which is services and print/mail revenue)

- a 9.6x multiple of FY2023 estimated (by me) software and payments revenue

Billtrust expects negative 8-10% adjusted EBITDA margins in FY2022. The company is growing net revenue and software/payments revenue at about 30% this fiscal year, including acquisitions. Its guidance is that it will be free cash flow positive in FY2023, Adjusted EBITDA positive in Q2/Q3 FY 2023, and adjusted EBITDA positive for the full year FY 2024.

A Nice Return to Early Investors

The acquisition price may disappoint those who bought at the peak in the public markets, but all in all, it looks like a good deal for shareholders. The stock is trading at $9.30/share today, suggesting the market is not expecting a bidding war!

Congrats are due to Flint Lane and his team, as well as the investors. The company appears to have taken in $300M in capital over its life. And even the SPAC private placement investors made some money if I’m reading this dealroom.co chart right.

Implications for Other Public Companies

Implications for Other Public Companies

If you are an avid reader of this blog you know that I am continually fascinated by the public and private valuations in the procure-to-pay and order-to-cash space. (See here, here, and here.)

When I wrote about the correction in these stocks in late December 2021, I wrote about 11 stocks. Four of these eleven have now been taken private by PE or strategic investors: Tungsten, Basware, Bottomline, and now Billtrust. If you are interested, that leaves seven public companies remaining: Coupa, Avidxchange, MDF Commerce, Mercell, Rosslyn Data, Cass, and Sidetrade. And I was missing a couple of others I won’t name for fun!

Dear Readers: What other public companies in the market am I missing? And who is next?

Corcentric, Bill.com

Another way to think about this is as part of a larger trend of publicly traded enterprise fintech companies being acquired by private equity:

– Avalara acquired by Vista

– Anaplan acquired by ThomaBravo

– Billtrust acquired by EQT

– Workiva rumored to be in discussions with ThomaBravo and PTG

– Zuora took $400M from SilverLake and is the next to be acquired IMO

All good points!