Please sing that title to the tune of the Beach Boys’ “California Girls.” Apologies to the Beach Boys, but I really do wish all private enterprise SaaS companies were UK-based. The UK requirement for private companies to file their audited financial statements is a gift.

UK Enterprise SaaS Companies

UK enterprise SaaS companies have been especially active in a few verticals. So I shook off my inherent laziness and examined financials for UK enterprise SaaS companies in five areas:

- Traditional Source to Pay (where UK enterprise SaaS companies also include public companies such as Tungsten)

- Supplier Information Management (where one of the founders of the category, Achilles Group, started)

- Construction Software

- Payments and Financing (where UK enterprise SaaS companies include GoCardless, Optal, Transferwise, and many more) (Covered in the next post.)

Source to Pay Companies

Wax Digital

Wax Digital was recently acquired by Medius (which is owned by Marlin Equity). (Marlin, as you may recall, made a killing selling Emptoris to IBM.) The transaction had me wondering about Wax’s financials. In 2018, Wax Digital had revenue of about $9.5 million and grew 9% from the prior year. EBITDA in 2018 was about 11%. Not earth-shattering, but very respectable. (Note: UK financials are free and audited, but not timely. You can’t have everything!)

Rosslyn Analytics

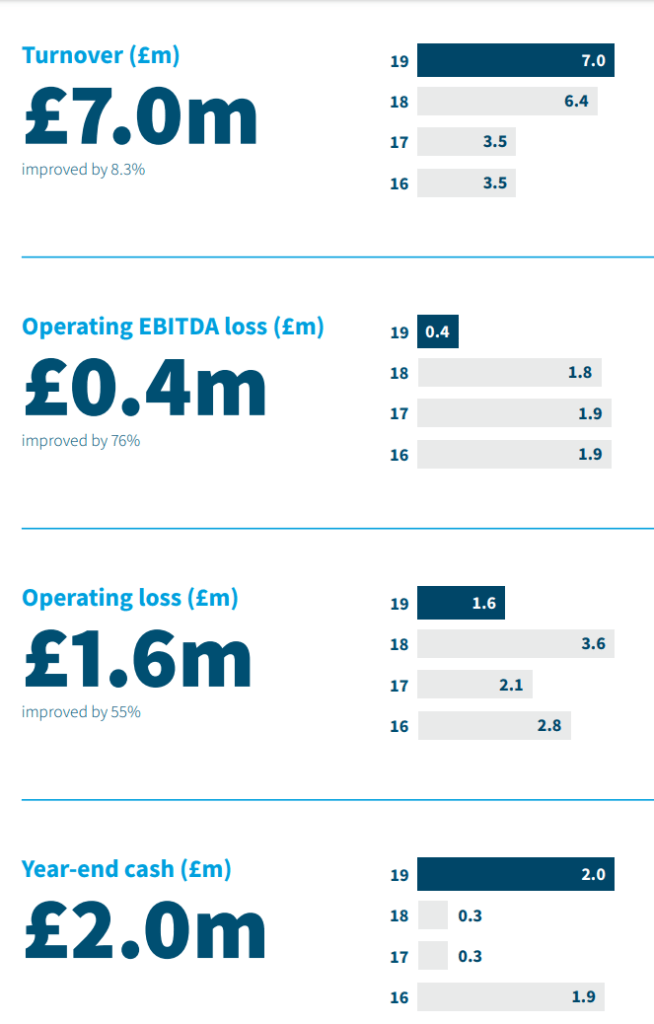

Rosslyn is a public company. The company started as a spend analytics company and has now expanded into supplier information management (SIM) (see below). For the year ended April, 2019, Rosslyn reported:

- £7 million in revenue and growth of 9% YoY

- A 78% gross margin, and

- EBITDA of -£0.4

Rosslyn’s market cap is just £9.5 million, less than 1.5x revenue. So if you are adventurous…

Supplier Information Management Companies

Achilles Group

Achilles is a pioneer of the supplier information management (SIM) market, specifically with respect to safety-related information. The safety sector has spawned several very successful companies including ISNetworld and Avetta. In its year-ended 2018, Achilles Group reported:

- Revenues shrank 4% to £61M

- A gross margin of 93%, suggesting some typical COGS expenses are below the gross margin line

- EBITDA (before exceptional items) of £6.5 or 11%. (Exceptional charges were £2.2 in restructuring costs for staff reductions.)

- 800 buyers were on the Achilles network along with 67,000 registered suppliers (down from 68,000 suppliers the year before)

Interestingly, ISNetworld lists 600 hiring clients and 73,991 contractors on their network. Avetta says it has 85,000 customers. Achilles seems to be a solid #3, making it quite valuable.

Sedex

Sedex is a well-established SIM company focused on the Environmental, Social, and Governance (ESG) attributes of suppliers. It’s similar to Achilles in business model (two-sided subscriptions) but focuses on a different type of supplier information. It’s more comparable to Ecovadis. In 2018, Sedex reported:

- Membership grew 12% to 54,232 members

- Revenue grew much faster to £13.7 million from £9.8 million (40%)

- A respectable gross margin of 72%

- Operating Income was approximately 6%, but EBITDA appears to have been closer to 15%

- Services were less than 15% of revenue, so memberships are more than 85%. This is consistent with the solid gross margin.

- Revenue is quite geographically diverse, with the least coming from North America.

This is a really nice company for someone to try to acquire.

Construction Software Companies

Causeway Technologies

I’ve long been fascinated by this company. Causeway has been quietly grinding away at building an e-invoice and payments network in construction (along with applications) since the bubble era. The Tradex network now boasts more than 140,000 organizations as participants and processes more than £6.1 billion in spend. The company has also been making the transition from license to SaaS revenue. The whole undertaking reminds me of a miniature, vertical Ariba. In 2018, Causeway reported:

- £25 million in revenue, up from £23 million

- Because of the transition to SaaS, ARR growth was faster than revenue growth. Causeway projects that, including acquisitions, it will report £30 million in ARR on £37 million in revenue in 2019

- Gross margins of about 78%

- EBITDA of about £5 million, so they are approaching “Rule of 40” territory

- Almost all of the revenue is from the UK

What a great little company.

Asite

Of all the companies listed so far, I know the least about Asite. It appears to be a collaboration platform for the construction industry in the mold of Aconex, RIB, Procore, or Buildertrend. Needless to say, this is a very hot market. For the year ended June 30, 2019, Asite reported:

- A 20% revenue increase to £9.6 million

- A gross margin of 85%

- Ebitda of approximately £3 million (more than 30%)

That’s impressive. Maybe someone will combine Asite and Causeway and build a UK construction category-killer?

In the next post, I’ll cover four additional UK enterprise SaaS companies in payments and financing.

Recent Comments